Introduction

In the world of construction and contracting, securing bonding insurance is essential. A bond serves as a safety net for project owners, ensuring that contractors fulfill their obligations. But how can a contractor ensure they receive the best bond rates available? One crucial tool in this endeavor is a robust business plan. This article delves into the intricacies of how a strong business plan can help you secure better bond rates, emphasizing its importance in building credibility with sureties, enhancing financial stability, and demonstrating project viability.

Understanding Bonding Insurance for Contractors

What Is Bonding Insurance?

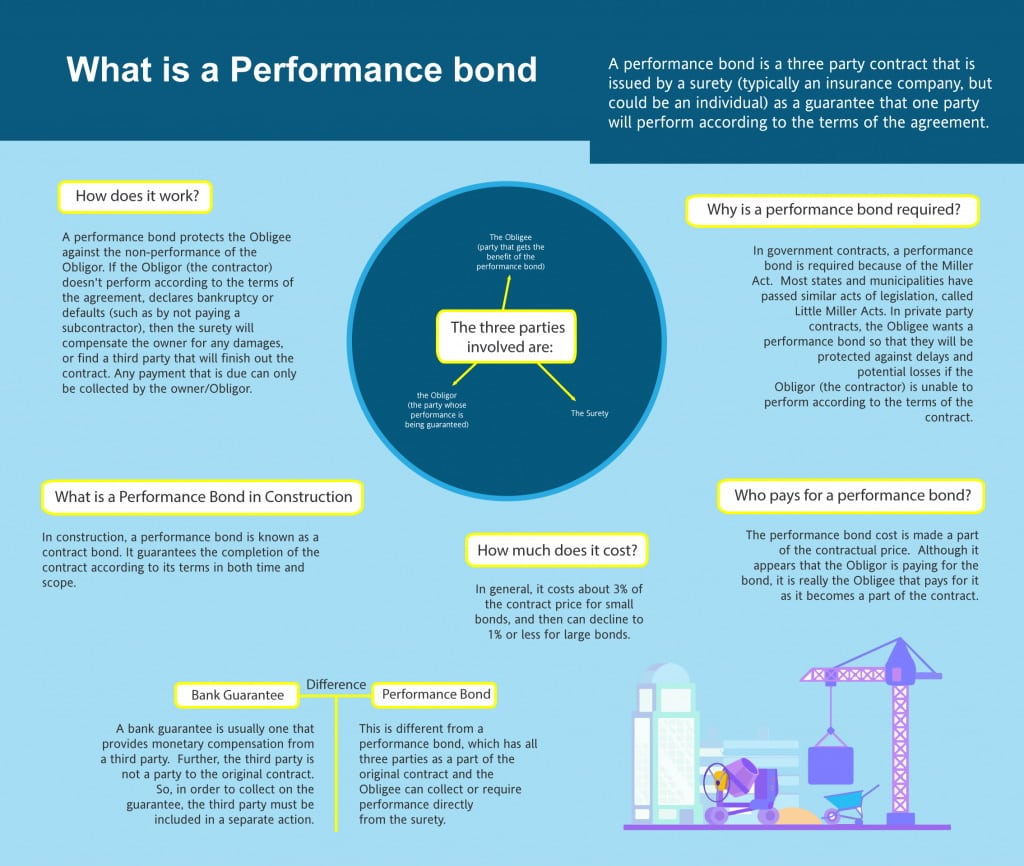

Bonding insurance for contractors refers to the assurance provided by a surety company that a contractor will complete their contractual obligations. It’s not merely insurance; it’s a three-party agreement involving the contractor (principal), the project owner (obligee), and the surety company.

Types of Bonds in Construction

Performance Bonds: Ensures that contractors complete projects according to the terms of the contract. Payment Bonds: Guarantees that contractors will pay their subcontractors and suppliers. Bid Bonds: Provides assurance that a contractor will follow through on their bid if selected for a project.The Importance of Bonding Insurance in Construction

Bonding insurance minimizes risk for project owners and allows contractors access to larger projects. A strong bond enhances a contractor's reputation and opens doors to new opportunities.

How Does Your Business Plan Influence Bond Rates?

The Role of Risk Assessment in Surety Bonds

Sureties assess risk before issuing bonds. A well-structured business plan helps mitigate perceived risks by demonstrating your preparedness and reliability.

Financial Health Indicators

Your business plan should include key financial indicators such as:

- Profit margins Cash flow projections Balance sheets Income statements

These elements reflect your financial health and can greatly influence your bond rates.

Key Elements of an Effective Business Plan

Executive Summary

An executive summary provides an overview of your business objectives and strategies, setting the tone for potential investors and sureties alike.

Company Description

Provide detailed information about your company, including its history, mission statement, and unique selling points. This establishes credibility with sureties.

Market Analysis

Conduct thorough market research to demonstrate your understanding of industry trends, competition, and target demographics.

The Financial Projections Section

Importance of Accurate Financial Forecasts

Financial projections are crucial in estimating future revenues and expenses over several years. These forecasts allow sureties to gauge your capability to meet financial commitments.

Creating Realistic Budgets

Ensure that your budgets account for both expected income and unexpected costs. This transparency builds trust with potential sureties.

Strategic Planning for Growth

Setting Measurable Objectives

Establish clear objectives related to growth, efficiency improvements, or market expansion within your business plan. This shows ambition while also being realistic about what can be achieved.

Adapting to Change

Discuss how your company plans to adapt to changes within the industry or economy. A flexible strategy can reassure sureties that you’re prepared for uncertainties.

Building Relationships with Sureties

Networking Strategies

Develop relationships with agents who specialize in bonding insurance for contractors. These connections can provide valuable insights into securing better rates.

Communication is Key

Maintaining open lines of communication with sureties fosters trust and increases your likelihood of obtaining favorable terms on bonds.

Documenting Your Experience

Showcasing Previous Projects

Include case studies or summaries of past projects in your business plan. Highlight successes where you've met or exceeded bonding requirements.

Case Studies on Successful Bond Procurement

Example 1: A Contractor's Journey

Analyze a real-world example where a contractor successfully secured lower bond rates due to an impressive business plan.

How a Strong Business Plan Can Help You Secure Better Bond Rates

A well-thought-out business plan acts as more than just an operational roadmap; it serves as an essential tool when dealing with bonding insurance providers. The clearer you present your strategies—ranging from financial management to risk mitigation—the more likely you are to secure favorable bond https://sites.google.com/view/swiftbond/performance-bonds/what-is-a-performance-and-payment-bond-and-how-does-it-protect-the-owner_1 rates from reputable surety companies.

By articulating your goals clearly within each section—especially concerning anticipated revenue streams and project execution plans—you provide assurance to potential surety partners about your capability and reliability as a contractor.

Importance of Compliance in Business Plans

Meeting Industry Standards

Ensure that your business plan aligns with industry regulations and standards; compliance is critical when dealing with bonding agencies.

The Role of Technology in Streamlining Your Business Plan

Utilizing Software Solutions

Investing in software tools designed for creating business plans can enhance accuracy while saving time during preparation processes.

Reviewing Your Business Plan Regularly

Importance of Continuous Improvement

Regularly revisiting and updating your business plan reflects adaptability—key traits highly regarded by sureties when determining bond eligibility and rates.

FAQs About Bonding Insurance for Contractors

What factors influence my bond rate?- Factors include credit score, experience level, financial stability, type of work performed, and market conditions.

- Yes! As you build experience, maintain good credit practices, and strengthen relationships with sureties.

- Not necessarily; however, many public projects require them as part of compliance with state laws.

- The surety may pay out on the bond; however, they will seek reimbursement from you.

- Yes! Maintaining excellent credit ratings and providing thorough documentation can lead to better rates.

- Experience instills confidence in lenders regarding your ability to fulfill contracts successfully—thus lowering perceived risks associated with bonding.

Conclusion

In conclusion, understanding how a strong business plan can help you secure better bond rates is crucial for any contractor looking to scale their operations effectively within today's competitive landscape. By focusing on elements like financial health indicators, strategic planning for growth, relationship-building with sureties, compliance adherence, regular reviews among others—contractors position themselves favorably not only towards obtaining necessary bonds but also towards achieving sustained success overall within their chosen markets.